Data Governance in the Financial Industry

The financial services industry serves as the backbone of the global economy, connecting a network of institutions and agencies that facilitate the exchange of money and capital, manage risk, and power economies.

Who needs Data Governance?

Banks

Financial institutions

Investment firms

Brokers

Operating under strict regulatory oversight, financial institutions handle trillions of dollars in assets for individual consumers to multinational organizations.

Regulatory agencies constantly adapt and adjust new policies related to the increased use of cloud-based technology, remote data access, and shifting consumer expectations.

Key Concerns

Regulatory Compliance

- Regulated specifics on storing different types of data and records, data privacy and access, and mandatory retention periods

- Overseen by the Financial Industry Regulatory Authority (FINRA), Securities and Exchange Commission (SEC), and Internal Revenue Service (IRS)

- Additional agencies regulate financial services data on a state level and internationally

The consequences of non-compliance include fines ranging from thousands to billions of dollars, suspending or revoking a license to operate, and potential criminal charges and legal cases. Institutions run the risk of damaging their reputation and losing the trust of clients.

Expanding Fintech

Fintech, or financial technology, includes digital innovations across all aspects of the financial services industry. Fintech innovations can increase the risks and concerns for data regulation:

- Digital wallets and payments

- Blockchain and cryptocurrency

- App-based lending and loans, such as Afterpay and Affirm

- Neobanks with no brick-and-mortar locations

- Robo-advisors

Finance Regulations

North American Regulations

SOX

Sarbanes-Oxley Act requires audit trails, access controls, and secure financial data retention.

GLBA

Gramm-Leach-Bliley Act mandates safeguards for customer data with mandatory encryption, access management, and breach response protocols.

BSA & PATRIOT Act

Bank Secrecy Act and USA PATRIOT Act support transaction monitoring, suspicious activity reporting, and secure data exchange with regulators.

Dodd-Frank Act

Enables secure data aggregation and reporting with required system transparency.

SEC Rule 17a-4

Requires immutable, time-stamped electronic records for dealers and brokers, including having a designated third-party.

NYDFS

New York State Department of Financial Services Cybersecurity Requirements enforces risk assessments, multi-factor authentication, incident response plans, and third-party risk management.

FFIEC

Federal Financial Institutions Examination Council provides specific guidance on cybersecurity, business continuity, and cloud risk management.

CFPB

Consumer Financial Protection Bureau supports secure handling of consumer complaints, data privacy, and fair lending analytics.

CIRO

Canadian Investment Regulatory Organization regulates investment dealers and mutual fund dealers.

EU & Global Regulations

DORA

Digital Operational Resilience Act requires financial entities to maintain robust ICT systems, incident reporting, and third-party risk oversight.

GDPR

General Data Protection Regulation regulates data privacy with data minimization, consent tracking, breach notification, and cross-border data controls.

FSOC

Basel III / Financial Stability Oversight Council supports stress testing, data lineage, and secure infrastructure for systemic risk analysis.

Agencies

SEC

Securities and Exchange Commission enforces electronic recordkeeping, cybersecurity disclosures, and incident reporting.

FTC

Federal Trade Commission oversees data privacy, breach enforcement, and deceptive practices in digital platforms.

FINRA

Financial Industry Regulatory Authority requires secure systems for trade surveillance, record retention, and cybersecurity controls.

OCC

Office of the Comptroller of the Currency reviews IT governance, third-party risk, and operational resilience in national banks.

FRB

Federal Reserve Board evaluates IT risk posture in systemically important institutions.

Financial Industry Solutions From Bluesource

Data Compliance

Proactively address compliance risks and obligations with our Compliance Assessment. We’ll help establish a clear baseline and offer strategic recommendations so you can be ready for an audit from any of the agencies overseeing financial regulations*.

*Assessments do not constitute formal certification

D3P Services

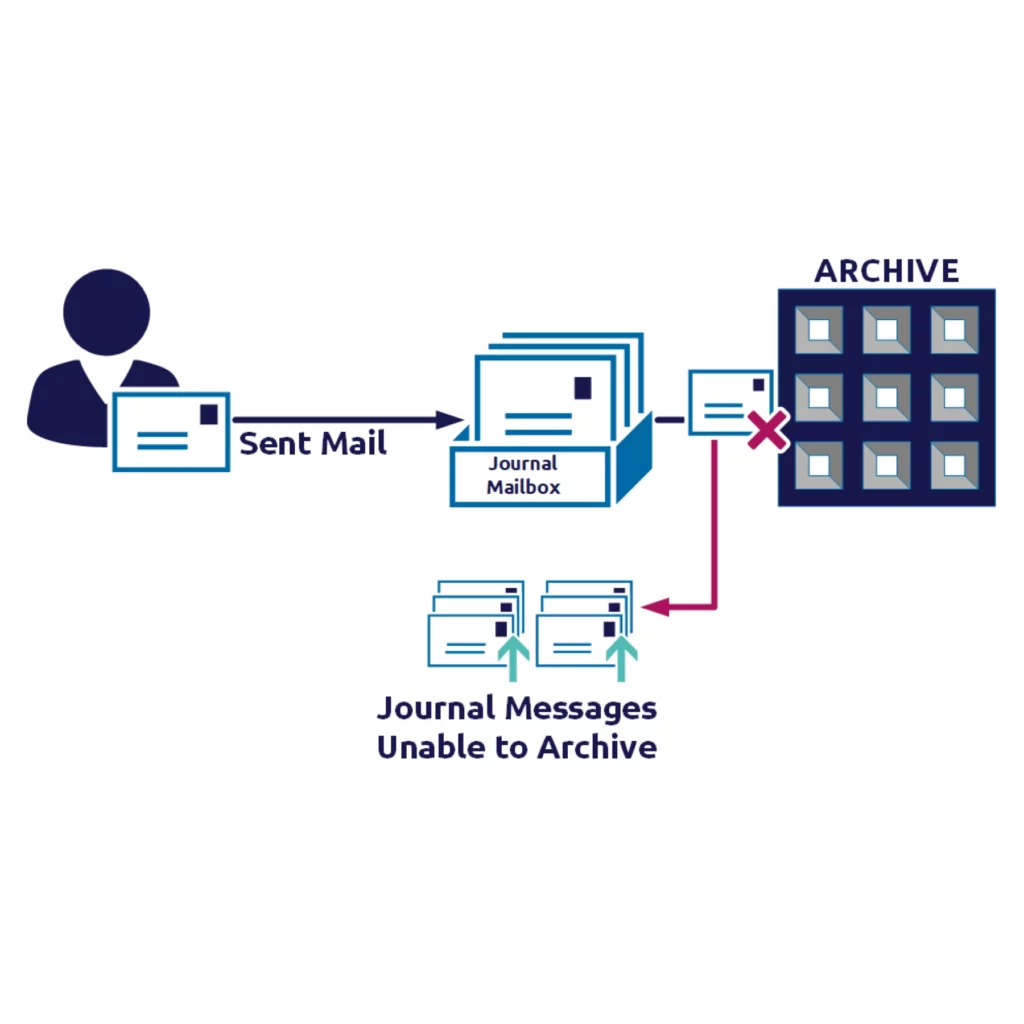

As a Designated Third-Party Service Provider, Bluesource maintains access to retrieve data in response to unfulfilled SEC requests. D3P Services ensures that financial institutions and dealer-brokers maintain compliance with SEC Rule 17a-4.

Managed Services

Leave the day-to-day management to Bluesource, and we’ll leave the financial management to you. Our managed services offerings include fully or partially managed solutions with Arctera, Microsoft, and Cloudlocker technologies.

eDiscovery

Quickly respond to regulatory requests, internal investigations and audits, and litigation inquiries with an optimized eDiscovery workflow. Bluesource has on-demand and fully managed solutions for every step of the Electronic Discovery Reference Model (EDRM) workflow.

Consulting

Bluesource has the data governance consulting expertise to serve as an extra set of hands for internal IT teams. We work with banks, brokers, and firms to provide consulting services around regulatory compliance, workflows, and risk management – especially with Microsoft and Arctera products.

- Health Checks

- Software Implementation

- Workflow Optimization

- Solution + Environment Design

- Software and System Upgrades

- Training